TAIPEI (TVBS News) — Taiwan's Central Bank (中央銀行) governor announced on Thursday (Nov. 14) that the central bank has successfully reversed the public's expectations of rising housing prices, and expressed hope that housing prices will gradually adjust by mid-2025.

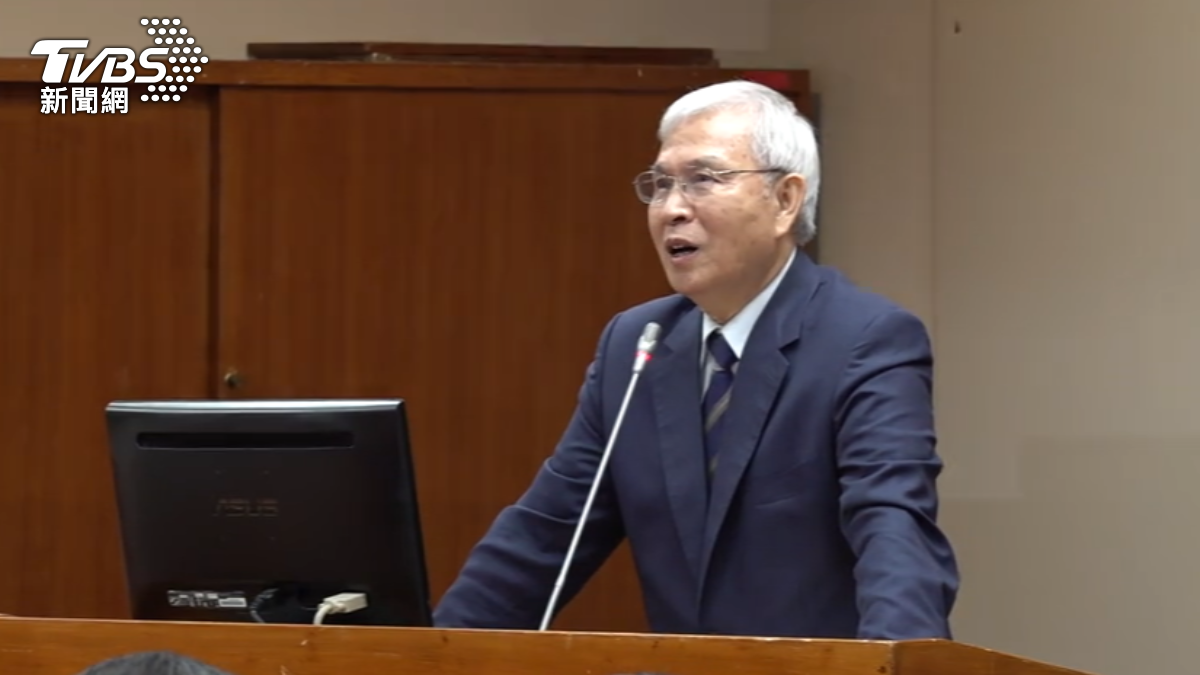

Attending the Legislative Yuan's Finance Committee (立法院財政委員會), Yang Chin-long (楊金龍) responded to concerns from Kuomintang Legislator Chen Yu-jen (陳玉珍) about the effectiveness of housing market controls.

Yang outlined three main objectives for the selective credit controls: ensuring banks adjust real estate lending, facilitating loans for first-time homebuyers, and reversing expectations of rising housing prices. He noted that evaluations indicate these goals have been met, suggesting there will be no eighth wave of controls.

Yang explained that domestic housing prices continued to rise, prompting moral suasion on domestic banks in August, followed by the September controls. These actions aimed to change public expectations of housing price increases.

He observed that online information indicates a halt in speculative expectations, although actual price adjustments may not occur until mid-next year. This gradual adjustment aligns with the central bank's desired outcome.

In September, the central bank implemented its seventh wave of selective credit controls, which it labeled as the most stringent anti-speculation measure to date.